IFRS 16 standard impacts and accounting

IFRS 16 will bring considerable changes in the equity structure and in the results of several companies, moreover, indicators will be affected- especially EBITDA.

HLB Brasil

IFRS 16 will bring considerable changes in the equity structure and in the results of several companies, moreover, indicators will be affected- especially EBITDA.

Therefore, it is extremely important to understand the impacts and the registration of these standards.

What was the standard until December 2018?

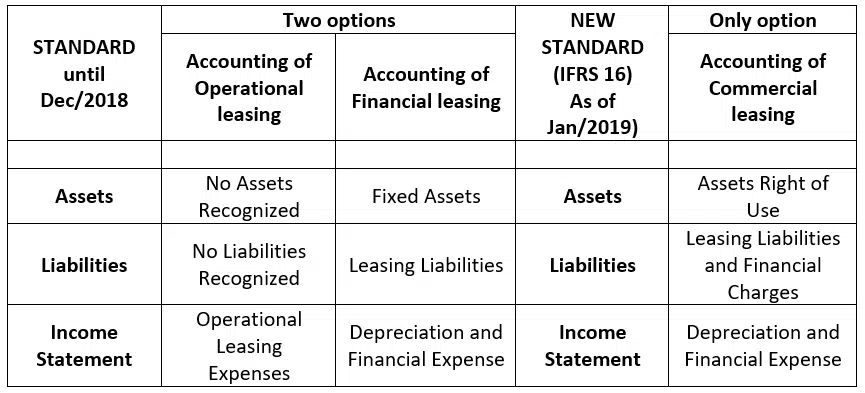

The previous standard: IAS – International Accounting Standard 17 defined that companies classify this format of operation as financial or operational leases.

In financial leasing, the transaction is similar to an asset sale, in which the lessee assumes both the risks and the benefits inherent to his ownership.

In operational leasing, the risks and benefits are borne by the lessor and the lessee must recognize the expense during the duration of the agreement, disclosing the commitment in an explanatory note.

What changes with the new standard IFRS16 ?

The new standard was issued in 2016, which originated from a joint action between IASB – International Accounting Standards Board and FASB – Financial Accounting Standards Board, which is the American Accounting Standards Board.

And, as of January 2019, IFRS16 will be mandatory for all countries that use IFRS. The changes will be in the scope of how the Financial Statements and leasing transactions should be accounted for.

The changes will affect the lessees, as the current model of the two classifications “Financial and/or Operational leasing” will be extinguished. In the new rule, the agreements must be presented in the same way as the financial leases and analyzed in their essence if the lessee will assume the risks and benefits with the agreement and even if there is an option to acquire the assets at the end of the agreement.

The impact of the new standard

– Entities will need to make sure they have processes and systems to obtain the information needed to implement the new standard.

– The amendments presented by IFRS 16 should affect the changes on internal processes and will directly influence the Balance Sheet and the income statement.

– Balance Sheet: Non-current assets, due to the recognition of the right to use the leased asset that will be greater, as well as current and non-current liabilities will increase due to financial charges.

– Income Statements: There will be an increase due to depreciation of the asset and the financial expenses of the liability that will be directly recognized in the result.

Summary table of accounting treatment before and after review of the new standard – IFRS 16:

Are there any changes for the lessor?

There are no substancial changes for the lessor.

Preparation for compliance with IFRS 16!

It is recommended that all agreements are reviewed, a detailed analysis of the clauses of each of them is performed and that internal control systems are implemented to quickly and accurately get information.

HLB Brasil can help you grow your business! Contact our Business Process Solutions team!