Provisional Measure n° 936/2020 - Labor measures to confront COVID-19

By Gabriela Resende

The Federal Government, through Provisional Measure n° 936/2020, edited complementary labor measures to face the COVID-19 pandemic. The complemente of the Provisional Measure establishes the Emergency Program for the Maintenance of Employment and Income, which aims to preserve employment and income, guarantee the continuity of work activities and reduce the social impact resulting from the consequences of the state of public calamity.

The main points for determining the Provisional Measure are described below:

- The payment of an Emergency Job and Income Preservation Benefit;

- The Proportional reduction of working hours and wages; and

- Temporary suspension of the employment contract.

The measures apply through individual agreement or collective bargaining only to employees with a salary equal to or less than R$ 3.135,00 or with a heigher education diploma with a monthly salary equal to or greater than 2 times the ceiling of the Social Security, that is, of R$ 12.202,12.

For the other employees not included in these characteristics, the measures provided for in this Provisional Measure can only be established by convention or collective agreement, except for the reduction of working hours and wages of 25%, which may be agreed upon by individual agreement according to the rules described below.

PAYMENT OF EMERGENCY EMPLOYMENT AND INCOME PRESERVATION BENEFIT

The benefit will be operationalized and paid by the Ministry of Economy, and paid for with Union resources, in the following situations:

- Proportional reduction of working hours and salary; and

- Temporary suspensions of the employment contract.

The benefit will be provided on a monthly basis and will be due from the date of the beginning of the reduction of the working day and salary oro f the temporary suspension of the employment contract, with the following observations:

- The employer must inform the Ministry of Economy of the reduction of the working day and salary or the temporary suspension of the employment contract, within ten days, counted from the date of conclusion of the agreement;

- The first installment will be paid within thirty days, counted from the date of the signing of the agreement, provided that the signing of the agreement is informed within the period referred to in item I; and

- The Emergency Benefit will be paid exclusively for the duration of the proportional reduction in the working day and salary or the temporary susspension of the employment contract.

If the employer does not inform the Ministry of Economy within ten days, the employer will be responsible for paying the employee’s previous remuneration, without reducing the work day and salary or contract suspension, as well as the respective social changes, until the information provided.

The receipt of the benefit does not impac on the granting of the Unemployment Insurance to which the employee is entitle in case of future dismissal.

The calculation of the benefit, regardless of the acquisition period, employment relationship and number of salaries received, will be as follows:

- When working hours and wages are reduced, the calculation basis will be the percentage of salary reduction;

- When the enployment contract is suspended, the amount will be monthly and equivalent to 100% of the unemployment insurance amount, being equivalente:

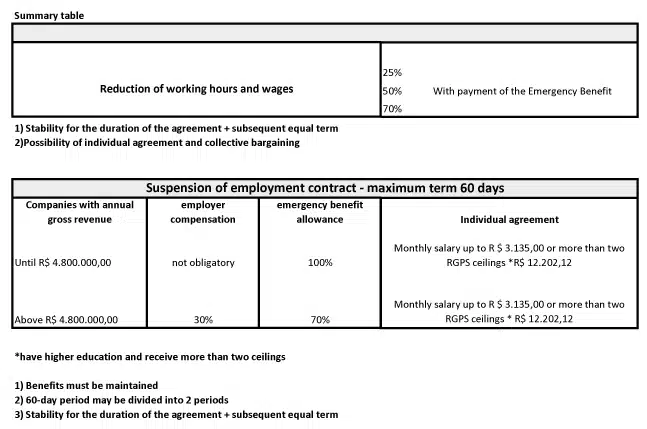

- To 100% of the amount of unemployment insurance to which the employee would be entitle, for companies with annual gross revenue less than R$ 4.8 million;

- 70% of the amount of unemployment insurance to which the employee would be entitled, for companies with annual gross revenue greater than R$ 4.8 million. In this case, the company must maintain the payment of 30% of the employee’s remuneration.

The employee in a public position or job, who enjoys the Social Security benefit, unemployment insurance or professional qualification scholarship (internship) will not be entitled to the benefit.

PROPORTIONAL REDUCTION IN WORKING DAYS AND SALARY

The option of the employer is established, by means of an individual written agreement with the employee and agreed 2 days in advance, of the proportional reduction of the working day and of the employees’ salary for up to 90 days, preserving the value of the hourly wage. The reduction can be made exclusively in the proportion of 25%, 50% or 70%.

The working hours and wages paid previously must be reestablished at the end of the state of public calamity, according to the date of the agreement agreed with the employee respecting the 90 days or if the employee about the decision to antecipate the end of the agreed reduction period.

TEMPORARY SUSPENSION OF THE WORK CONTRACT

The employer may agree, by individual written agreement with the employee and agreed 2 days in advance, the temporary suspension of the employment contract for a maximum period of 60 days, which may be divided into up to 2 periods of 30 days.

During the period of temporary suspension of the contract, the employer must maintain all benefits granted to the employee, as well as pay the Social Security as an optional insured.

The employment contract will be reestablished at the end of the state of public calamity, according to the date of the agreement agreed with the employee respecting the 60 days or if the employee about the decision to anticipate the end of the contract suspension.

During the period of suspension of the employment contract, the employee will not be able to provide services to the employer, even partially or through teleworking. If services are provided during the contract suspension period, the employer must immediately pay the remuneration and social charges for the entire period of suspension, as well as bear the penalties provided for in the current law and collective agreement.

For companies with 2019 gross annual revenue in excesso of R$ 4.8 million, you can only suspended the employment contract by paying a monthly compensation of 30% of the employee’s salary. In this case, compensation will take place as follows:

- Must have the value defined in the individual agreement agreed or in collective negotiation;

- Will have an indemnity nature;

- Will not be included in the IRRF calculation base;

- Will not be included in the Social Security calculation base and other taxes levied on the payroll;

- Will not be included in the calculation basis of the amount due to the Guarantee Fund;

- May be excluded from net income for purposes of determining corporate income tax and Social Contribution on Net Income taxed by taxable income.

PROVISIONAL GUARANTEE IN EMPLOYMENT

The employment guarantee is recognized for the employee who receives the Emergency Job and Income Preservantion Benefit:

- During the agreed period of reduced working hours and wages or temporary suspension of the employment contract; and

- After the reestablishment of the working day and salary or the end of temporary suspension of the employment contract, for a period equivalente to that agreed for the reduction or suspension.

In the event of unfair dismissal during the employment guarantee period, the employer will be required to pay indemnity, in addition to severance pay, of:

- 50% of the salary to which the employee would be entitled during the job guarantee period, in the event of a reduction in working hours and a salary equal to or greater than 25% per cent and less than 50%;

- 75% of the salary to which the employee would be entitled during he job guarantee period, in the event of a reduction in working hours and a salary equal to or greater than 50% na less than 70%; or

- 100% of the salary to which the employee would be entitled in the period of guarantee in the employment, in the hypotheses of reduction of the working day and salary in a percentage superior to 70% or temporary suspension of the employment contract.

Individual agreements to reduce working hours and wages or suspend the employment contract, agreed under the terms of this Provisional Measure, must be communicated by employers to the respective Union, within up to 10 calendar days, counted from the date of its execution.

NEGOTIATIONS IN COLLECTIVE AGREEMENTS

Measure to reduce working hours and wages or suspend employment contracts referred to in this Provisional Measure may be entered into through collective bargaining. In this case, the Emergency Employment and Income Preservation Benefit will be paid in the following terms:

- There will be no payment of the benefit for the reduction of working hours and wages of less than 25%;

- Payment of 25% on the calculation basis provided for in article 6 for the reduction of hours and wages equal to or greater than 25% and less than 50%;

- Payment of 50% on the claculation basis provided for in article 6 for the reduction of hours and wages equal to or greater than 50% and less than 70%; and

- 70% payment on the calculation basis provided for in article 6 for the reduction of working hours and wages over 70%.

During this period, electronic means may be used to convene and negotiate collective agreements.

Gabriela Resende is director of HR for Clients HLB Brasil.